Contact a Top-Rated Financial Advisor for Free

Need financial help and not sure where to start?

We have a guide for every major topic:

- Retirement Planning Guide

- Financial Planning Guide

- IRA Investment Guide

- 401k Investment Guide

- Estate Planning Guide

- Annuity Investment Guide

- Bond Investment Guide

- Mutual Fund Investment Guide

- CD Investment Guide

- Pensions Guide

» See Details About Each Guide

Are You Saving Enough?

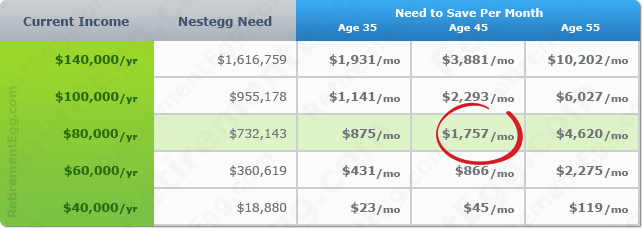

We're safe in assuming NO right off the bat. Statistics show that you significantly underestimate how much you'll need for retirement. Statistics also show that you are not contributing enough each month to meet that need. Let's have a look at how much you should be saving based on your current income level:

Surprised? Are you saving as much as you should? If not, your retirement is in jeopardy. If you're curious about these figures be sure to View the Full Table. In short, these numbers are a simplification of your retirement savings needs and may actually be greater or lower, but they still serve as a good guide. Notice that for every 10 years that you delay saving for retirement you will need to save 2 to 3 times as much per month!

Problems Facing 21st Century Retirees

Today's retirees are faced with a growing set of economic challenges that feel outside their control. These problems are further compounded by media coverage of market volatility, politics, and Wallstreet shenanigans that often leave us feeling helpless and disillusioned. In reality, prudent financial planning is more important today than ever before and you have more power than ever before to take control.

There's no denying that market risk is real. But so it the risk of doing nothing. Inflation, rising health care costs, changing tax structures, the inadequacy of social security and medicare, and rising life expectancies are all real as well. What we need are intelligent ways to tackle these problems. RetirementEgg.com has been written to provide sensible advice about how to take immediate control of your financial future.

The first step is to get properly motivated to take action. Let's start by considering today's leading threats to your retirement:

Inflation: You may not notice it, but prices on goods and services are always rising. 24 years from now $200 will be equivalent to $100 today! And that's assuming a modest 3% inflation. Between 1925-2010 the average annual rate of inflation (or rise in CPI) was 3.0%. Between 1965-2010 the average annual rate of inflation was 4.1%. What does this mean? If you don't grow your income, you will lag behind. And if you depend on a fixed income to provide for retirement, you will be in trouble within a decade's time.

Growing Life Expectancy: Did you know that a 65 year old in 2005 had a 70.0% chance of living to age 80 and a 30.3% chance of living to age 90? This might be welcomed news, but not in light of today's average retirement saving account balance. People are living longer but saving less. The average Baby Boomer will need a nestegg of $500,000 - $1,000,000 at the age 65 to maintain their standard of living at retirement. Yet on average, Americans aged 55-64 only have $271,701 in their retirement accounts.

Uncertainty of Social Security: By now we've all seen the projections. There are many models floating around predicting various levels of social security shortfall, but they all agree that the current system is fundamentally insolvent and will lead to significant social security benefit cuts in the future. Today, the official age to start receiving benefits is 67, but this number must rise in the coming years to keep the system working. Reduced annual payouts are also a near-certainty. The days of simply relying on social security to meet your retirement needs are over. To the contrary, if you're planning to retire 20+ years from now it's best to assume you will have no social security assistance.

Rising Healthcare Costs & Medicare: Life expectancy rises every year and yet more and more Americans suffer from chronic health conditions and obesity. Luckily for us, medical technology is keeping pace, but at what price! As more Americans rely on drugs and long-term medical care to keep there bodies ticking, medical technology becomes less and less affordable. Given that Medicare can't keep pace with this growing strain over the medium-to-long term, today's retirees need to focus on living healthier and saving more for healthcare.

Steady Decrease in Pension Coverage: Defined contributions plans, or "pensions", have declined drastically over the past 20 years. Private-sector employees have been especially hard hit. In the new world economy companies are finding it too expensive to carry the burden of everyone's life-long retirement needs. Instead they have unanimously chosen the 401k. But a 401k does not provide the same level of security as a traditional pension. A 401k must be actively managed, can lose capital, and cannot provide a guaranteed life-long income. As a result, most retirees are left to fend for themselves.

Market Instability: The last two decades, from the Dot-com burst to the Mortgage bust, have been the most volatile in history. Today, the S&P 500 is actually below where it was in 2000 and 2007. Taking into account dividend yield, the S&P 500 is still slightly positive, but these numbers show the importance of understanding market major cycles. The era of buy-hold-and-forget investing are over, at least in the United States. The world economy is in full swing and knowing where to invest your retirement money and how to keep your resolve through market downturns will be critical in the future.

Debt vs Savings Mentality: The reality is that no amount of prudent investing can return an annual yield of 15%-20%, yet many Americans pay that much interest on their credit card purchases every month. Living in debt is the equivalent of financial suicide because you have to work harder and harder just to stay even. The solution to this problem is to change how we think about spending and savings. Building discipline muscles is the foundation of any worthwhile retirement plan.

The #1 Secret To Lasting Financial Success

We'll be the first to admit that there are no gimmicks or shortcuts when it comes to retirement planning, but there actually is a #1 secret: Discipline! Discipline is your commitment to follow through and stick to the fundamentals. That's it! Sounds simple, doesn't it? It IS simple, but simple isn't easy. After all, deep down we all know that knowledge, action, discipline, and sound strategy are the keys to all success (financial or otherwise) yet we rarely put this knowledge to work. This website, RetirementEgg.com, is about you taking back control by:

- Building your financial discipline

- Providing you with accurate investment and financial planning information and analysis

- Replacing your get-rich-quick mentality with a healthy long-term mindset

- Giving you the tools to do your own research

- Motivating you to take action

These 5 points, as simple as they seem, are the true keys to mastering your finances and securing a comfortable retirement. We don't offer the latest stock tips and we make no promises of getting rich or retiring early. Instead, we give you a healthy dose of knowledge and motivation about HOW and WHY to grab your finances by the horns right now!

Why Discipline is the Key

When reading retirement planning literature, examples like the following are quite common:

"If John saves $300/mo starting at age 35 at 10% interest, after 30 years John will have a nestegg of over $651,000".

But what's wrong with this hypothetical? The problem is, it only works IF John contributes $300/mo for 30 YEARS STRAIGHT! Think of the discipline and commitment needed to make that happen. Are you saving with the same kind of consistency? Probably not. Why? Because life gets in the way. Yogi Berra had a great saying, "In theory, there is no difference between practice and theory, but in practice there is." When it comes down to it, you must be steadfast to align reality to theory. That's why discipline is the #1 key to getting the retirement you want.

Retirement Saving vs Retirement Planning

One of the biggest problems with retirement planning is that most Americans don't begin to act on it early enough. Luckily its also one of the easier problems to correct. The key is to distinguish between retirement savings and retirement planning. While it's okay to put off planning until your 50's, the same cannot be said of saving.

Saving is critical in two respects: 1) savings are what build the initial capital necessary to earn a meaningful income from interest alone, and 2) compound interest rates need time for a meaningful geometric effect to kick in. By not saving early enough you are not giving your nestegg the time it needs to mature. Just like you wouldn't expect your children to support themselves at age 10, so you shouldn't expect a retirement nestegg of age 10 to support you.

The solution is simple: begin saving for retirement as soon as you get a full-time job, even if you have no idea about how you will use that money. The important thing is to build the foundation. Do whatever you must to keep a steady inflow of cash into your IRA, 401k, or other retirement account. Planning will come later.

Calculating Your Real Retirement Need

The best way to make sure you're on the right track is to define exactly how large a nestegg you will need at retirement. Unfortunately this calculation can be get complicated due to the variety and unpredictablility of the factors involved. For example, will you be receiving a full or partial social security benefit? What will be your effective tax rate at retirement? How much will your pensions pay? What will the be average rate of inflation over the next 20-30 years? How much will your investments yield over the next 20-30 years? Will you own a home at retirement? How much debt will you have? And of course, what lifestyle will you live?

Some of these factors are easier to ballpark than others. A great way to start is by completing a retirement budget. You can download the Retirement Budget Excel file here. While filling it out you will determine your retirement lifestyle and calculate a basic retirement income need. This number can serve as a starting point which can be adjusted by factors like social security benefits, tax rates, inflation, and investment yield.

Don't Cut Corners with Your Retirement!

Some financial issues are best done with the help of a professional who:

- Is experienced with the process

- Can calculate your retirement needs more accurately

- Has access to more products at better rates

- Understands tax issues

- Can help you build discipline

- Can suggest smart alternatives

Retirement Planning Guide

Click Here to access the Retirement Planning Guide. This guide will teach you everything you need to jumpstart your retirement plan. Use the shortcuts below to access specific areas of interest:

- Retirement Income Options — Explore ways to save for retirement and generate retirement income. We cover IRAs, 401(k)s, Pensions, Annuities, Stocks, Mutual Funds, Bonds, CDs, and more.

- Retirement Savings Tips — Saving for retirement isn't always easy, but with these simple tips you can learn to build up your retirement saving muscles.

- Retirement Planning Pitfalls — The road to retirement is often long and winding, but most retirement planning mistakes can easily be avoided by simply knowing they exist.

- Retirement Taxes — Over the course of 30-40 years of saving for retirement, even reducing tax liability by 1% can make a huge difference. Make sure you understand these retirement tax considerations.

- Retirement Inflation — Inflation is the single greatest enemy of retirement planning, and often the biggest retirement planning gotcha. Learn how to position your portfolio to outpace inflation.

- Asset Allocation & Diversification — Picking the right stocks isn't nearly as important as picking the right mix of investments. Learn how proper diversification can shelter your nestegg from undo risk.

- How to Build a Solid Retirement — The key to building a retirement nestegg is discipline. Learn how a few fundamental rules of thumb, coupled with investing knowledge, can lead to amazing results.

- Early Retirement — Being able to retire early isn't a matter of luck, it's about developing an unusual level of fiscal prudence and dedication. Learn how the fundamentals of planning an early retirement.

- Retirement FAQ — Got a question about retirement? There's no need to wait. Chances are we have your answer in our list of over 40 top retirement planning questions.

Financial Planning Guide

Click Here to access the Financial Planning Guide. This guide will teach you everything you need to get a handle on your finances. Use the shortcuts below to access specific areas of interest:

- Making Investments — There's a difference between following up a stock tip and prudent long-term investing. Learn about how these Big Four investment instruments can used to build big wealth.

- Life, Health, and Property Insurance — The secret to insurance is getting only even coverage to protect your financial well-being. Find out which types of insurance you need, and which types you don't.

- Credit and Borrowing — Mismanaging your credit is the single fastest way to tank your financial well-being, yet not all credit is bad. Learn the difference between good vs bad credit.

- College Savings Plans — With the rising cost of college admissions, if you have children, saving for their education is financial necessity. Explore how college savings plans can help and which is right for you.

- Tax Considerations — Nothing may be more certain than death and taxes, but a close third certainty is your ability to pay less taxes than you currently do. Find out how to reduce tax liability.

- Financial Advisors — Finding the right financial advisor isn't always easy. Learning about advisor titles and credentials, and which questions to ask prospective advisors, will ease your search.

- Financial Planning FAQ — Got a question about financial planning? There's no need to wait. Chances are we have your answer in our list of over 15 top financial planning questions.

IRA Investment Guide

Click Here to access the IRA Investment Guide. This guide will teach you everything you need to choose the right type of IRA for you. Use the shortcuts below to access specific areas of interest:

- Traditional IRAs — The traditional IRA is the go-to retirement savings account. Learn how traditional IRAs work, what you need to qualify, how much you can contribute, and more.

- Roth IRAs — The Roth IRA is the ideal retirement savings account for individuals within certain tax brackets. Learn about how Roth IRAs work, their eligibility requirements, contribution limits, and more.

- Roth vs Traditional IRAs — You've decided to use an IRA to build your retirement nestegg, but which type is best? Explore how Roth IRAs stack up against Traditional IRAs.

- IRA Rollovers — If you just switched job, chances are you'll want to roll over you IRA, but what are the rules? Learn tips for rolling over a Traditional or Roth IRA.

- IRA Rules an Limits — Are you eligible for an IRA? What about a Roth IRA? What if you're married or single? And how much can you contribute. Find the latest IRA rules and limits here.

- SEP IRAs — If you're self-employed, the SEP IRA might be your best retirement saving option. Learn about the benefits of SEP IRAs and how they work.

- 457 Plans — If you work for the government or a non-profit, a 457 plan might be your best retirement savings option. Learn how 457 plans work and their contribution limits.

- Best IRA Rates — Picking the right IRA is only half the challenge. Learn which investments you can make inside your IRA and how to they will impact your retirement plan.

- IRA FAQ — Got an IRA question? No need to wait. See answers to over 30 top IRA investment questions.

401(k) Investment Guide

Click Here to access the 401(k) Investment Guide. This guide will teach you everything you need to know about maximizing your 401(k). Use the shortcuts below to access specific areas of interest:

- 401(k) Rollovers — If you recently switched jobs, you'll want to make sure your old 401k gets rolled over correctly. Find out how 401k rollovers work and how to handle special cases like 401k to IRA rollovers.

- 401(k) Rules and Limits — Are you getting the most out of your employer-offered 401k? Understanding 401k rules and contribution limits specific to your age-group and 401k type is critical to this end.

- 401k Loans — While it's generally best to leave your 401k alone, sometimes getting a loan against your 401k makes sense. Find out how 401k loans work and when it's prudent to take out a loan.

- Solo 401k — If you're self-employed, you're probably wondering how to substitute a traditional 401k. Learn how a Solo 401k can give you small business owners the benefits of a traditional 401k and more.

- 401k FAQ — Got a question about your 401(k)? No need to wait. See answers to over 30 top 401k investment questions.